Gift planning... Simplified

Who Knew That Giving Could Give You So Much Back?

Since 1998, Link Charity has provided the service, tools, education, and guidance that individuals and charities need when it comes to gift giving. Our wide variety of Gifting Options is current, relevant, and designed to help both the individual and the charity. Explore our Giving Tools below!

Blog

A Will is one of the most important documents you will ever create. It ensures your assets are distributed according to your wishes, protecting your loved ones and providing for their future. But what if your Will could do more? What if it could be a testament to your values, a final statement of what mattered most to you, and a way to support the causes you championed throughout your life? This is the power of turning your Will into a lasting legacy. Planned giving allows you to make a significant impact on the world long after you are gone. By including charitable contributions in your estate plan, you can create a legacy of generosity that reflects your passions and supports organizations doing vital work. This article will explore how you can transform your Will into a powerful tool for change, the benefits of doing so, and the steps you can take to get started. The Power of a Legacy Gift When you think about the legacy you want to leave, what comes to mind? For many, it's about being remembered for kindness, compassion, and a commitment to making a positive difference. A charitable bequest in your Will is a concrete expression of these values. It’s an opportunity to give a final, powerful gift to a cause that has touched your heart. This act of planned giving extends your influence beyond your lifetime. It allows you to support advancements in medical research, protect the environment, fund educational scholarships, or provide aid to those in need. The ripple effect of your generosity can be felt for generations, creating a story of impact that becomes a permanent part of your life's narrative. Emotional and Practical Benefits The decision to leave a charitable gift is deeply personal and brings with it a unique sense of fulfillment. Knowing that you will continue to support causes you care about provides a profound sense of peace and purpose. It’s a way to ensure your values endure and continue to shape a better future. Beyond the emotional satisfaction, there are practical advantages. Charitable bequests can offer significant tax benefits for your estate. A gift to a registered charity can reduce the amount of tax your estate owes, potentially leaving more of your assets for your beneficiaries. This strategic approach to estate planning allows you to maximize your generosity while being a good steward of your resources. How to Create Your Charitable Legacy Transforming your Will into a legacy document may seem complex, but it can be a straightforward process with the right guidance. Here are actionable steps to help you begin your journey of planned giving. 1. Identify Your Passions Start by reflecting on what truly matters to you. What causes have you supported during your lifetime? What change do you want to see in the world? Your gift will be most meaningful if it aligns with your core values. Consider areas such as: ● Healthcare and medical research ● Education and youth programs ● Environmental conservation ● Arts and culture ● Faith-based initiatives ● Humanitarian aid Make a list of the organizations you admire or the issues you want to address. This will be the foundation of your charitable giving plan. 2. Consult with Professionals Estate planning requires careful consideration. It’s essential to seek advice from financial advisors and legal professionals. They can help you understand the best way to structure your gift to achieve your philanthropic goals while ensuring your family is provided for. These experts can explain the different types of bequests you can make, such as a specific dollar amount, a percentage of your estate, or the remainder of your estate after other obligations are met. Their guidance is crucial for creating a legally sound and effective Will. 3. Partner with an Expert Organization Managing charitable donations through an estate can be complicated. This is where organizations specializing in planned giving become invaluable partners. A trusted entity like Link Charity Inc. can simplify the entire process, ensuring your philanthropic vision is carried out exactly as you intended. These organizations act as a bridge between you and the charities you wish to support. Instead of naming multiple charities in your Will, which can create administrative complexities for your executor, you can name a single organization like Link Charity Inc. You provide them with a list of your chosen charities, and they handle the distribution of funds after your passing. This streamlines the process, reduces administrative burdens, and ensures your gifts reach their intended destinations efficiently. Working with an expert facilitator provides peace of mind. They have the expertise to manage various types of assets, navigate any legal requirements, and honor your specific instructions. This ensures your legacy is protected and your final wishes are fulfilled with precision and care. 4. Document Your Wishes Clearly Once you have a plan, it's time to formalize it. Work with your lawyer to draft or update your Will to include your charitable bequest. Be specific about the charities you want to support and the amount or percentage you wish to give. If you are working with a facilitator like Link Charity Inc., your Will would name them as the beneficiary. You would then complete a separate, simple agreement with them detailing the final distribution to your chosen charities. This approach offers flexibility, as you can update your list of charities with the facilitator at any time without having to formally change your Will. Your Legacy Starts Today Creating a Will is an act of responsibility. Turning it into a legacy is an act of vision. By planning today, you can ensure that your compassion and generosity create a lasting impact for years to come. You have the power to support the causes that define you and to leave a legacy of positive change. Start the conversation with your family and financial advisors. Explore the charities that inspire you, and consider partnering with an organization that can help bring your philanthropic goals to life. Your Will is more than a legal document—it is your final opportunity to make a difference. Make it count.

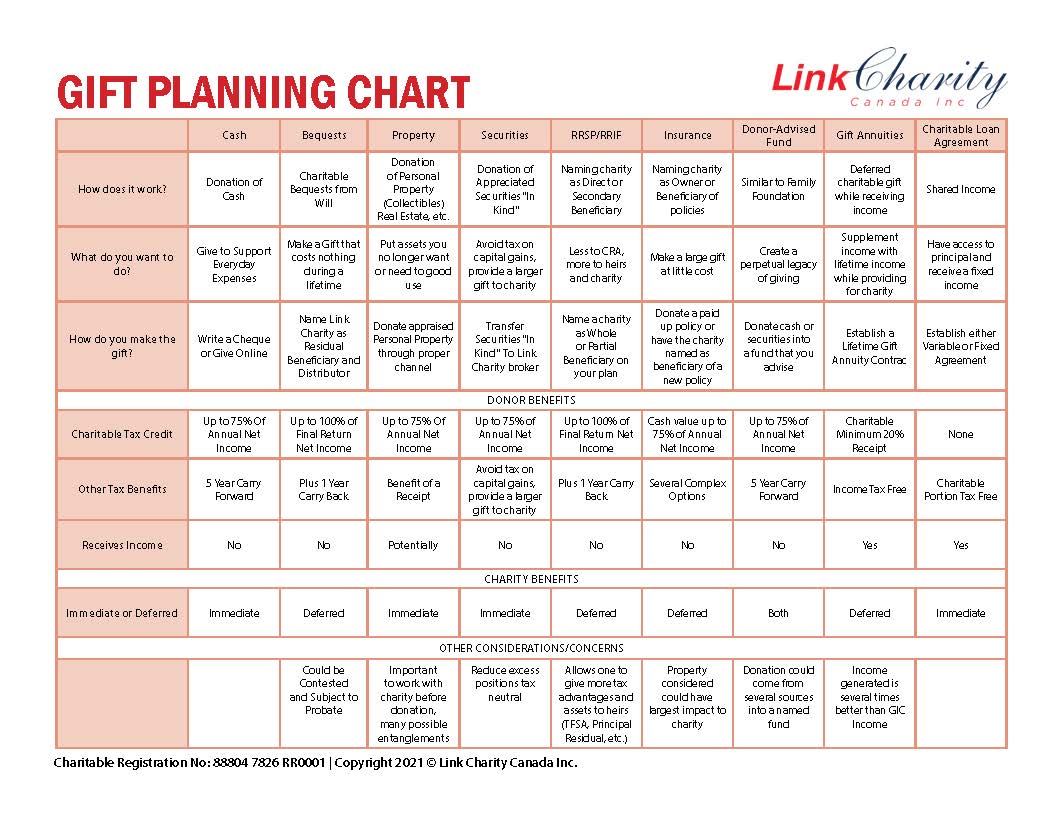

Link Charity Canada Inc. is a leading facilitator of planned giving in Canada, dedicated to bridging the gap between donors and charitable organizations. Founded by Harry Houtman in partnership with five original charity members, the organization simplifies the administration of charitable gifts and provides essential tools to maximize the impact of philanthropy. Since 1998, Link Charity has offered guidance, education, and service to both individuals and charities. By operating as an intermediary, they connect donors with over 30 member charities and more than 1,100 other charities across Canada, having provided $16.9 million in funding between June 2024 and June 2025 alone. Core Services and Donor Advantages Link Charity streamlines the donation process, offering several strategic advantages for donors: ● Tax Efficiency: Their expertise in estate planning and gift structuring can significantly reduce fees and taxes, maximizing the value of the gift. ● Convenience: They offer a platform for donating stocks and mutual funds that saves on brokerage fees. ● Anonymity: Donors have the option to remain anonymous while supporting causes that matter to them. ● Simplified Administration: They handle the administrative burden of complex gifts, such as setting up Family Foundations or managing annuities. ● Confidentiality: All interactions and transactions are handled with strict confidentiality. Gifting Tools Link Charity provides a comprehensive suite of gifting options designed to suit various financial situations and philanthropic goals: ● Charitable Gift Annuities: The #1 provider in Canada, offering amazing ROIs (5-10% depending on age). This allows donors to support multiple charities through a single annuity while receiving a guaranteed income stream. ● Gifts of Securities: A convenient and economical way to donate stocks and mutual funds, often resulting in capital gains tax savings. ● Donor Advised Funds: Enables donors to establish a "Family Foundation" without the high costs and legal complexities of creating a private foundation. ● Estate Planning & Bequests: Expert assistance in incorporating charitable giving into wills and estate plans to leave a lasting legacy. ● Life Insurance: Facilitating the transfer of existing policies or the purchase of new ones to create a substantial future gift with manageable current premiums. ● RRSP/RRIF: Strategies for donating registered retirement funds to offset taxes. ● Charitable Loan Agreements: Flexible lending options for charitable purposes. Contact Information Link Charity Canada Inc. ● Address: 604 – 789 Don Mills Road, Toronto, ON, M3C 1T5 ● Phone: 1-800-387-8146 ● Email: info@linkcharity.ca ● Charitable Registration No: 88804 7826 RR0001 ● Website: www.linkcharity.ca

Life insurance is often seen as a way to protect our loved ones financially. It provides a safety net, ensuring that mortgages can be paid and futures are secure. But what if your policy could do more? What if it could also become a powerful tool for change, supporting a cause you are passionate about long after you are gone? By designating a registered charity as your life insurance beneficiary, you can create a significant, lasting impact. This guide will walk you through how this process works, the benefits it offers, and how organizations like Link Charity can help you turn your policy into a powerful gift. How to Name a Charity as a Life Insurance Beneficiary Making a charity the beneficiary of your life insurance policy is a straightforward process. It’s an effective way to make a substantial donation that might not be possible during your lifetime. There are a few primary ways to structure this type of gift: 1. Name the Charity as a Beneficiary This is the simplest method. You can name a charity as the sole beneficiary, a partial beneficiary (e.g., 50% to your family, 50% to the charity), or a contingent beneficiary. A contingent beneficiary would receive the payout if your primary beneficiaries are no longer living when the policy is paid out. You simply update the beneficiary designation form provided by your insurance company. 2. Transfer Ownership of an Existing Policy You can transfer the ownership of a paid-up policy directly to a charity. The charity becomes the new owner and beneficiary. When you do this, you may receive a tax receipt for the cash surrender value of the policy at the time of the transfer. This provides an immediate tax benefit for you. 3. Purchase a New Policy for the Charity Another option is to take out a new life insurance policy with the express purpose of donating it. You name the charity as the owner and beneficiary from the start. You then make annual payments to cover the premiums. Each premium payment is considered a charitable donation, making you eligible for a tax receipt each year. The Powerful Benefits of Gifting Life Insurance Donating through life insurance offers unique advantages for both you and the charity you choose to support. It’s a strategic way to amplify your giving potential. Significant Impact for a Modest Cost Your premium payments are a fraction of the final death benefit. This allows you to make a much larger gift than you might otherwise be able to afford. A policy with manageable annual premiums can result in a transformative donation of tens or even hundreds of thousands of dollars for your chosen cause. Tax Advantages for You and Your Estate Gifting life insurance comes with compelling tax benefits. ● Premium Payments: If a charity owns the policy, your premium payments are considered charitable donations, earning you annual tax credits. ● Estate Benefits: When a charity is named the direct beneficiary, the death benefit is paid directly to them and does not pass through your estate. This means the payout is not subject to probate fees. Your estate then receives a donation receipt for the full amount of the death benefit, which can significantly reduce or even eliminate taxes owed by your estate. Supporting a Cause You Believe In Beyond the financial benefits, this is a way to create a meaningful legacy. You can provide long-term support for an organization whose mission aligns with your values. Whether it’s advancing medical research, protecting the environment, or supporting community services, your gift ensures that work continues. Simplicity and Privacy Designating a beneficiary is a private matter between you and your insurance provider. It is not part of your will and therefore not subject to the public probate process. It’s a simple form to complete and can be updated if your circumstances change. Making It Easy with Link Charity Navigating the world of planned giving can feel complex, but organizations exist to simplify the process. Link Charity is a prime example of an organization that helps donors facilitate these kinds of gifts. Link Charity works as an intermediary, connecting donors with over 30 different member charities. Their expertise lies in managing planned gifts, including life insurance policies. Here’s a brief overview of how they can help: ● Expert Guidance: Their team can provide information and help you understand the different ways to gift a life insurance policy, ensuring you choose the option that best suits your financial goals and philanthropic vision. ● Simplified Process: They handle the administrative details of setting up and managing the donation. This ensures the process is smooth and that your gift is handled correctly. ● Flexibility: Working with an organization like Link Charity allows you to support one or more of their member charities. You can direct your gift to a specific cause you are passionate about within their network. By partnering with an organization like Link Charity, you can be confident that your donation will be managed professionally and used effectively to fulfill your charitable intentions. A Legacy That Lasts a Lifetime and Beyond Your life insurance policy is more than just a financial tool; it's an opportunity to make a final, powerful statement about what matters to you. By naming a charity as a beneficiary, you can leave behind a legacy of generosity that will continue to create positive change for years to come. If you are interested in exploring this option, a great first step is to speak with your financial advisor or insurance provider. You can also reach out to your favorite charity or an organization like Link Charity to learn more about their specific planned giving programs. It’s a simple step that can lead to an extraordinary impact.

Creating a Will is one of the most important things you can do for yourself and your loved ones. It’s your final message, a clear set of instructions that ensures your assets are distributed exactly as you intend. Without a well-thought-out Will, you leave those decisions to the courts, which can lead to conflict, confusion, and outcomes you never would have wanted. Proper estate planning provides immense peace of mind, knowing your legacy will be handled according to your wishes. This guide will walk you through the importance of being specific in your Will, particularly when it comes to charitable giving. We will explore how you can leave a lasting impact and why clarity is key to honoring your intentions. Why a Vague Will Creates Problems Imagine you leave a note saying, "I'd like some of my money to go to charity." While the sentiment is wonderful, the instruction is too vague to be legally executed. Which charity? How much money? Who makes the final decision? This ambiguity can cause significant delays and disputes among your beneficiaries and the executor of your estate. When your wishes are not clearly defined, the responsibility falls on your executor to interpret your intentions. This can place them in a difficult position, trying to guess what you would have wanted. In many cases, provincial or state laws will dictate how your assets are distributed if your Will is deemed unclear or invalid, which may not align with your goals at all. Clarity is your greatest tool. By being specific, you remove all doubt and ensure a smooth process for everyone involved. You protect your loved ones from the stress of uncertainty and guarantee your legacy is exactly what you envision. The Importance of Specificity in Your Will A strong Will leaves no room for interpretation. It provides precise details that guide your executor through every step of the process. Naming Beneficiaries Clearly It’s not enough to say "to my children" or "to my spouse." You should name each beneficiary by their full legal name and their relationship to you. This prevents any confusion, especially in blended families or situations where names may be similar. Defining Assets and Distribution Clearly outline what assets each beneficiary will receive. This can be a percentage of your total estate, specific monetary amounts, or tangible items like property, vehicles, or family heirlooms. The more detailed you are, the less chance there is for disagreement later. For exampl instead of "my jewelry," specify "my diamond engagement ring" or "my grandfather's gold watch." Leaving a Legacy Through Charitable Giving A charitable bequest, or a gift made through your Will, is a powerful way to support a cause you care about long after you are gone. It allows you to make a significant impact on an organization whose mission you believe in. For many people, this is a cornerstone of their legacy. Just like with other parts of your Will, specificity is crucial when planning a charitable gift. You need to clearly state which organization you want to support and what form your donation will take. Naming a Specific Charity To ensure your donation reaches the right place, you must identify the charity by its full, official name and its registered charity number. For example, simply writing "the cancer society" is not enough. You need to specify the exact organization, such as "The Canadian Cancer Society." If you are looking for reputable charities and want to explore your options, resources are available to help. A great place to start is www.linkcharity.ca , which provides information on various organizations and how you can support their work. Exploring their site can help you find a cause that aligns with your values and learn the correct details needed for your Will. What Can You Donate? Your charitable gift doesn’t have to be a simple cash sum. There are many ways to give, and you can choose the one that works best for your financial situation. A Percentage of Your Estate: You can designate a percentage (e.g., 10%) of your residual estate to a charity. The residue is what’s left after all debts, expenses, and specific gifts to loved ones have been paid. A Specific Dollar Amount: This is a straightforward cash gift of a predetermined amount. Assets and Property: You can donate real estate, stocks, bonds, or valuable personal items. These are known as "gifts in kind." Life Insurance Policies: You can name a charity as the beneficiary of a life insurance policy.This is a simple way to make a large gift with relatively small, manageable premium payments during your lifetime. By outlining these details, you empower the organization to continue its important work and create a legacy of generosity that reflects your values. Final Steps for Peace of Mind Drafting a Will is not a one-time task. It’s a living document that should be reviewed every few years or whenever you experience a major life event, such as marriage, divorce, the birth of a child, or a significant change in your financial situation. Working with a legal professional who specializes in estate planning is the best way to ensure your Will is legally sound and accurately reflects your wishes. They can help you navigate the complexities of the law and structure your Will, including any charitable bequests, in the most effective way possible. Planning for the future is a profound act of care for those you leave behind. By creating a clear, specific, and thoughtful Will, you provide a final gift of certainty and peace. You ensure that your legacy, whether it’s providing for your family or supporting a cherished cause, is honored exactly as you intended.

When planning for the future, many people think about how they can make a meaningful impact even after they’re gone. Incorporating a charitable bequest in your will is one way to achieve this goal. It offers you the opportunity to extend your generosity, ensuring the causes you care about continue to thrive beyond your lifetime. This blog explores what charitable bequests are, the benefits they can provide, and how organizations like Link Charity Canada can simplify the process of integrating philanthropy into your estate planning. Understanding Charitable Bequests A charitable bequest is a gift specified in your will or estate plan that directs some portion of your estate to a specific charity or charitable cause. These gifts can take on various forms, which makes them versatile and accessible to donors from all walks of life. Types of Charitable Bequests Specific Bequests: These indicate a particular dollar amount or a specific item to be donated. For example, you might leave $10,000 or a piece of artwork to a favoured charity. Percentage Bequests: This specifies a percentage of your total estate to be gifted. For instance, you might decide to allocate 10% of your estate to a nonprofit organization. Residual Bequests: These bequests involve donating the remainder of your estate after other beneficiaries have received their share. Residual bequests ensure your intended heirs are prioritized, while still leaving a gift for charity. Contingent Bequests: A contingent bequest only takes effect under specific conditions. For instance, you might name a charity as a beneficiary if your primary beneficiary passes away before you. Gifts of Securities or Assets: Charitable bequests aren’t limited to cash. You can donate stocks, bonds, real estate, or even shares in a business, providing financial benefits for both you and the beneficiary. The Benefits of Charitable Bequests Including charitable bequests in your estate plan offers personal and financial rewards, creating a win-win scenario that can leave an enduring legacy. 1. Support the Causes You Care About A charitable bequest is one of the most powerful ways to reflect your values. Whether you’re passionate about education, healthcare, environmental protection, or religious missions, your bequest ensures these causes receive the support they need. 2. Create a Lasting Legacy Donations to charity through your estate extend your generosity far into the future. This legacy demonstrates a commitment to making the world a better place, inspiring your loved ones and community. 3. Tax Advantages There are practical perks to adding philanthropy to your estate plan. Gifts made to registered charities typically qualify for tax exemptions that can reduce the taxable value of your estate, resulting in more savings for other beneficiaries. Gifting publicly traded securities can also help you sidestep capital gains tax, maximizing the impact of your donation. 4. Flexibility Life circumstances evolve, and so can your charitable intentions. Bequests are easily adjusted through updates to your will, ensuring your legacy adapts to reflect your values and priorities over time. 5. Ease for Executors By clearly stating your charitable intentions in your will, you minimize administrative burdens and provide clear instructions for your executor. This reduces confusion and the potential for disputes. How Link Charity Canada Can Help Managing an estate and including charitable bequests can feel overwhelming. That’s where organizations like Link Charity Canada come in. They streamline and simplify the process, helping donors maximize the value of their gifts and their impact on the causes they care about. 1. Donor-Advised Funds One of Link Charity’s standout offerings is their donor-advised fund. This service consolidates your charitable giving, allowing you to direct all gifts through one account. It offers flexibility, ensuring that multiple charities can benefit from one plan, while also giving you the ability to amend your instructions without revisiting your will. Here’s how it works: You make a single bequest to Link Charity Canada. Then, via a letter of direction, you specify how and where the funds should be distributed. You can revise your instructions at any time without needing costly legal amendments to your will. 2. Tax Benefits and Strategic Planning Link Charity specializes in helping you maximize the tax advantages of your charitable giving. For example: Donating securities like stocks or bonds through your estate can eliminate the capital gains tax on appreciated value. Your estate receives a tax receipt for the full current value of the gift. Donations can offset estate taxes, leaving more of your estate to heirs and charities. Their experienced advisors guide you through these options, ensuring you get the maximum tax benefits while effectively supporting your chosen causes. 3. Legacy and Estate Planning The advisors at Link Charity understand how important it is to honor your wishes. They work closely with you to plan a charitable legacy that reflects your passions and leaves a meaningful impact. Whether you want to benefit local charities, religious institutions, or educational organizations, their expertise ensures your gifts are handled with care and respect for your intentions. 4. Anonymous Giving Options If you prefer discretion, Link Charity allows for anonymous giving. This ensures that you can support meaningful causes while retaining your privacy. For full information on Charity Bequest, please visit our Charity Bequests .